Can i unlock a bank checking account instead of a social Safety amount?

- June 25, 2024

- where to get a payday loan near me

Usage of financial is important getting setting up a beneficial financial models and you can steering clear of the large costs usually for the solution financial services. Whenever you are opening a bank account try seemingly simple, it does introduce a problem to possess immigrants, and people who are not used to the usa and possess limited English proficiency, together with those who go into the country without paperwork.

Along, you will find forty-two.9 billion immigrants in the You.S., 10.step three million away from whom is undocumented. Information banking legal rights can be make certain immigrants have the ability to availability the fresh new financial products and services needed.

Trick Takeaways

- You will find a projected 49.nine billion immigrants in the united states, and ten.3 billion undocumented immigrants.

- Of numerous immigrants might not understand their financial rights otherwise how exactly to discover a checking account, particularly if it lack the called for documents to achieve this.

- Code traps may prevent immigrants out-of looking for the brand new banking services and products they need to ideal would their money.

- Being unaware of their banking liberties could easily costs immigrants several or even thousands of dollars from inside the way too many costs.

Bank accounts and you will Immigration Condition

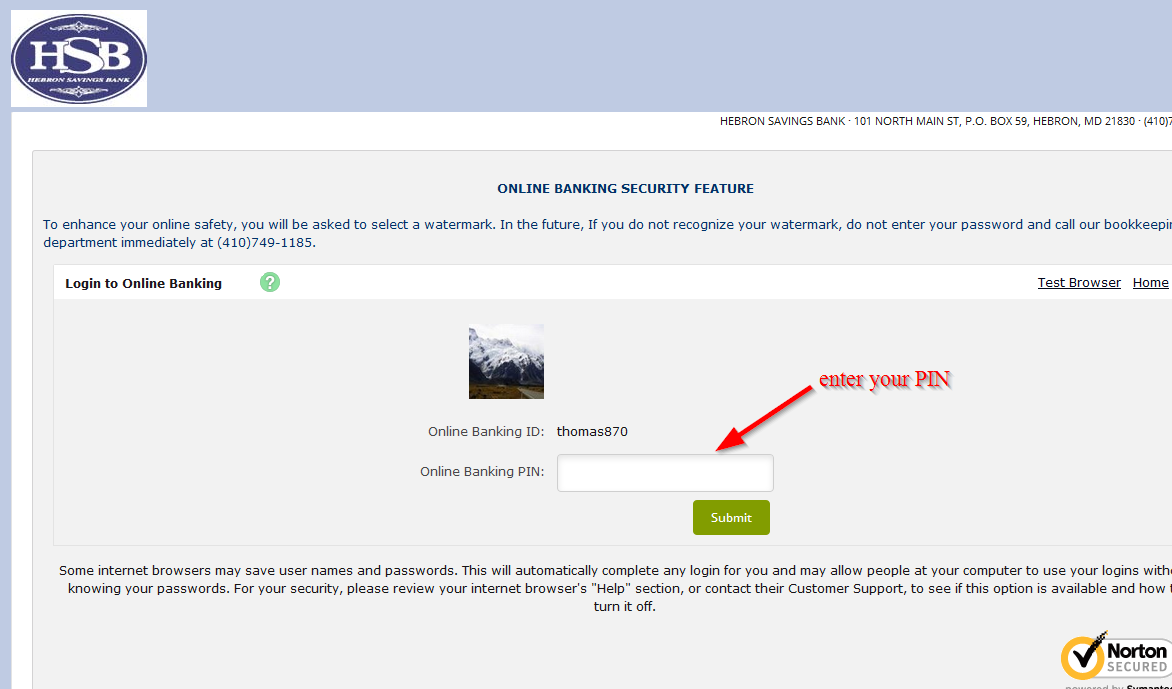

Probably one of the most are not requested issues one immigrants might have is if one may discover a bank account instead a beneficial Social Shelter matter. This new small response is sure, one may score a bank checking account instead of a personal Coverage matter when you can provide other forms away from supporting records otherwise personality. The average advice that banking institutions must discover a different sort of membership were your own:

- Identity

- Day out of birth

- Address

- Identity

In place of a personal Safeguards https://cashadvancecompass.com/loans/flex-loans/ number, it is possible to have immigrants to open up a bank checking account using a keen Private Taxpayer Identity Count (ITIN). Which amount, issued because of the Irs (IRS), is designed for individuals who don’t possess and are generally not eligible for a personal Protection matter. ITINs was granted no matter what immigration condition and will be studied to open up a bank account.

An ITIN cannot authorize one to work in the fresh U.S., neither will it bring qualification getting Personal Safety experts or meet the requirements a dependent to own Gained Tax Borrowing from the bank (EITC) motives.

- An effective nonresident alien that has needed to document an effective U.S. income tax come back

Credit cards and you will Finance getting Immigrants

Bringing a charge card or financing will help satisfy monetary means and will be a way to establish and build an excellent You.S. credit score. Immigrants feel the directly to submit an application for financing and you can playing cards, and you may a lot of financial institutions and you will lenders provide her or him. There are, however, specific limits and you may conditions.

For example, Deferred Step for Youthfulness Arrivals (DACA) users is actually ineligible to have federal education loan apps. not, capable discover individual college loans of finance companies and other loan providers, and additionally signature loans or automotive loans. Meanwhile, almost every other noncitizens may be able to successfully apply for federal scholar financing if they provide sufficient records.

Particular Indigenous American people born in the Canada having a status less than new Jay Pact out of 1789 can also be qualified to receive federal beginner services.

Qualification having private student loans, unsecured loans, automotive loans, or mortgage loans may vary out-of financial so you can financial. Such as for example, no confirmation out of citizenship or immigration reputation may be needed in the event the the applying can provide an ITIN and proof earnings. An excellent passport and other identification may also be expected accomplish the borrowed funds software.

As much as credit cards wade, a great amount of financial tech (fintech) enterprises have developed borrowing activities especially for those who lack a social Shelter amount. Candidates are able to use an enthusiastic ITIN rather to acquire acknowledged. When they in a position to discover a merchant account, they may be able after that fool around with one to establish and construct a card history, which can make they easier to be eligible for financing.

Majority are a mobile financial app customized for immigrants one to comes with customized use of financial without overdraft fees or foreign exchange fees.

Mortgage loans to have Immigrants

To invest in a house normally form delivering home financing, and you may immigrants feel the directly to get a home loan on the You.S. The largest trouble with providing recognized is being capable fulfill the brand new lender’s degree conditions for employment records, credit history, and you can proof of money. Without having a credit rating in the U.S., including, that create more difficult for lenders to assess your own creditworthiness.

Beginning a checking account that have a global bank who’s got You.S. twigs otherwise with a U.S. financial can assist you to establish an economic background. Once again, you could potentially open a bank checking account that have a keen ITIN, and your financial will get allow you to submit an application for a mortgage with your ITIN as well. Looking around examine financial choices can help you discover a financial which is prepared to help.

Giving a bigger down payment can make they better to be considered for a home loan in the You.S. when you have immigrant standing.

Sure, you could potentially legally discover a bank account even in the event your have a social Cover amount and you can irrespective of your own immigration standing. Plenty of banking institutions and you will borrowing from the bank unions deal with a wide range regarding character files, as well as just one Taxpayer Character Amount (ITIN), to open a bank checking account.

What exactly is a keen ITIN?

The inner Funds Service (IRS) products ITINs to those that are needed to file tax statements and are usually not eligible to score a social Protection count. Brand new ITIN can be used as opposed to a personal Cover amount whenever starting a unique savings account otherwise trying to get certain funds and you will handmade cards.

Perform I must tell you immigration documents to open a bank account?

No. Financial institutions and you may borrowing from the bank unions shouldn’t request you to show their immigration updates to open up a bank checking account. If you think that a lender or some other financial institution is discerning facing you according to your immigration status, you can file a criticism from Federal Reserve Human body’s Individual Grievance form on the internet.

Is also illegal immigrants features a bank checking account?

Yes, undocumented immigrants on You feel the right to open a bank checking account. Once more, banking institutions cannot need you to establish your immigration updates in order to unlock a merchant account.

This is author biographical info, that can be used to tell more about you, your iterests, background and experience. You can change it on Admin > Users > Your Profile > Biographical Info page.”

About us and this blog

We are a digital marketing company with a focus on helping our customers achieve great results across several key areas.

Request a free quote

We offer professional SEO services that help websites increase their organic search score drastically in order to compete for the highest rankings even when it comes to highly competitive keywords.